Cheque Truncation System (CTS)

Cheque Truncation System (CTS) or Image-based Clearing System (ICS) for faster clearing of cheques. CTS is basically an online image-based cheque clearing system where cheque images and Magnetic Ink Character Recognition (MICR) data are captured at the collecting bank branch and transmitted electronically.

Virmati’s vCTS component is having two separate processes :

Direct CHI Clients:

- Cheque Scanning

- Batch Preparation for Direct CHI Clients

- Mapping of Booking Clearing & Scanning of Cheques.

- Generate Outward Clearing File (CXF/RRF)

- Import Inward Clearing File (PXF)

- Import Outward Return File (RF)

- Extension Request File (ERF)

- Extension File Processing (EF)

- Extension Item Release

- CHI Response Upload (RES)

- CHI Acknowledgement Upload (OACK)

vCTS component reports:

- Branch wise & Lot Wise Report

- Inward & Outward Return Register

- Extension File Report

- Pending Outward Details

- CHI UnProcessed Register

- Print Cheques

CTS Features in CBS Product/Component:

- Clearing Branch & City wise Lot Processing.

- Marking for CTS & Non CTS Clearing Branch

- Booking of Outward Clearing with separate Clearing Type like e.g. CTS or Non CTS, MICR, Non-MICR, MMBCS etc.,

- Lot wise Batch preparation for each Clearing Type.

- Outward Return Marking

- Clearing Type wise Processing of Inward Clearing Transactions.

- Display of Cheque Images while Inward Clearing Processing.

- Clearing Type wise Inward Return Marking.

Scope

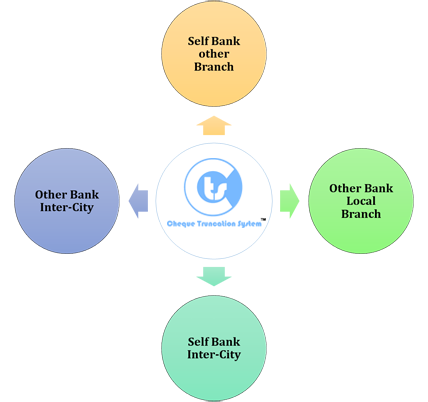

The System will cover 4 types of clearing, both on outward and inward mode

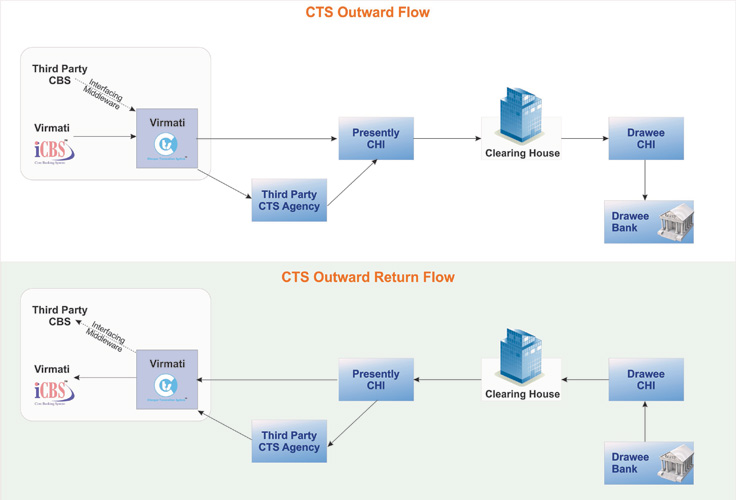

functionality required at the Branch for Outward Clearing:

- Capturing of image including MICR track

- Capturing of other details through entry

- Maintaining of database of image and details

- Archival & retrieval of the database

- Accounting for Branch Automation/CBS for update (ISO8583 format)

- Audit trail and query functions

- Handling of accounting when cleared or returned

On the reverse way, it has the functionality for Inward Clearing:

- Import of file

- Display of image received & data

- Entry of details for completion

- Authorization by viewing the signature [on call from CBS]

- Update of accounting through ISO8583 Interface

- Handling of return

- History maintenance, storage, archival, retrieval, audit trail, query etc.

At the Service Branch level, it has the functionality as under:

- Receipt of images from branches and consolidating into the database

- Preparing a batch and forwarding to clearing house

- Accounting and its reconciliation

- Maintenance of database

- Archival, retrieval, audit trail, query etc.

- Upon receipt of images from other Banks, re-routing to Branch and their accounting

- Handling of clearing returns