Financial Inclusion &/or Branchless Banking

Banking & Finance Industry is discovering the immense capabilities and is increasingly adopting Mobile, POS & similar Hand-Held Devices to take banking services to the common man or better serve the existing customers.

As part of Technology Leadership, Virmati, has always thought ahead of times and invested in developing and bringing cutting-edge banking technologies to the Banks & Institutions; The Banks & Institutions can take a leap-frog in Technology Advancement & transform the Banking Experience of their customers.

Considering the varying nature of Banks, their Vision, Target Audience, Regional dis-similarities in Trade & Technology, Virmati has developed an excellent, robust framework to deliver end-to-end services of Branchless Banking or Financial Inclusion or Banking through Kiosks or Banking through Correspondents, whichever is the preferred mode.

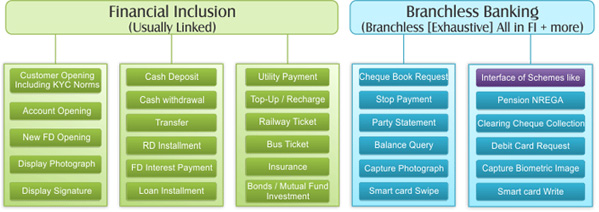

There are subtle as well as significant differences in the functionalities, modes of delivery and many other aspects of each Variant (Branchless Banking or Financial Inclusion or Kiosk Banking or Correspondent Banking. Broadly, we categorize the various variants into two major variants. In the ensuing pages, we elaborate the same. They are:

Here, the Bank or Institution targets to acquire customers and offer limited but growing list of banking facilities through a Hand-Held Device operated by an authorized Agent.

The idea is to introduce and to capture banking requirements in a target area or audience where so far it has not been viable to operate or where a low cost, viable Service Model is desirable.

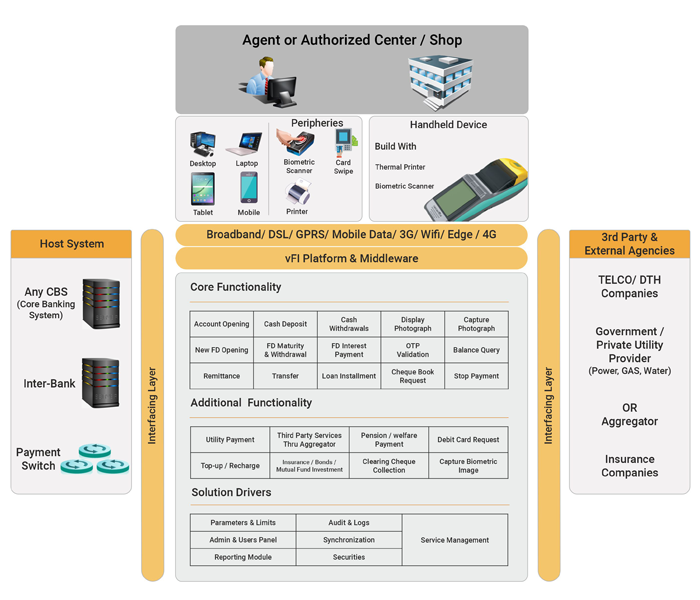

Functional Architecture

Functionality of FI &/or Branchless Banking

Our Foot Prints

VSTL End to End solution offerings

a.Middleware / Platform b. Device with Application Software c. Card Management d. BC (Business Correspondent) e. FI portal (browser base)

The Solution is built around POS Device. This Device has Biometric Support, Smart Card Support, Camera Support, Printer support.

The device is GPRS supported and hence, the mobile GPRS will be the mode of connectivity for the particular POS device. This will be managed by the Bank/institution.

VSTL also provides for the interfacing to the host CBS system. This would be XML/Web Service based Interfacing or ISO 8583 standard interface.