Industry Trends

Regulators are increasingly requiring banks to use modern technology to ensure that regulatory compliance requirements are effectively met.

The Reserve Bank of India (RBI) has been driving the adoption of new technologies & processes like eXtensible Business Reporting Language (XBRL), Online Return Filing System (ORFS), Centralized Data Repository & Automated Data Flow.

The vision is to have Banks adopt a straight through process requiring least or negligible manual intervention in enabling Compliance & Statutory Reporting to flow from their Transaction Systems

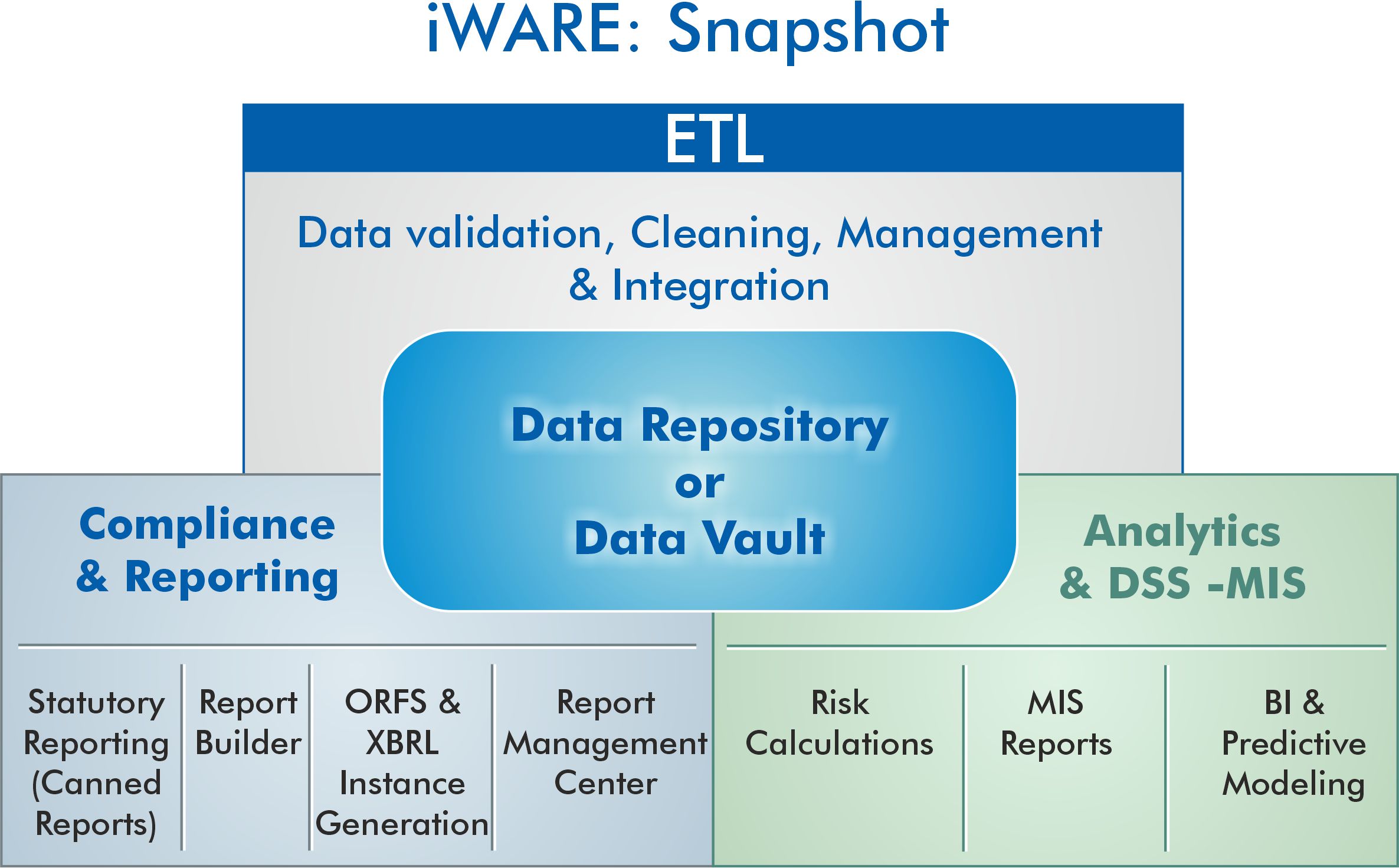

At the centre-stage will lie the Centralized Data Repository (CDR or a Data Vault or a Data Warehouse) which will be a single repository of validated data, originating from various source systems within the Bank, be it Core Banking or Treasury or similar.

RBI & regulators believe that the above will also enhance the Risk Management capabilities of the Banks/FI

Perspective & Expectations of Banks/FIs

To respond to this emerging scenario, a 2 Step Strategy has evolved & been recommended.

As a first step, Banks/FIs need to ensure a seamless flow of data from their Operational & Transactional Systems to the Central Data Repository (CDR) or Data Vault.

As a second step, the CDR or Data Vault will promote & allow the generation of statutory reports, or even MIS/DSS & Risk Management Reports. In course, Banks/Fis will vastly improvize their MIS and Decision Support Systems (DSS) capabilities with BI Tools and enablers like Dashboards, Score Card & KPIs.

Virmati's iWARE Solution: Mission Enabler & Achiever

Virmati's iWare Solution brings a Centralized & Unified Platform for Repository and Compliance. It facilitates Banks/FIs to create a Data Repository, Automate Statutory Compliance & and further extend the system to promote BI, MIS & DSS.

iWARE is a culmination of extensive research & work experience with leading Banks in India. It has distilled key attributes and capabilities which will propel high performance

Banks/FIs derive the following distinguishing advantages with iWARE

- Unified Data Vault, giving a Correct & Singular State of Affairs

- Improvement & Richness in Quality of Organizational Data

- In-Time, Accurate, Flexible and Informative Reporting & Analytics

- Smooth, Automated Statutory Reporting & Compliance

Ability to Integrate & add other niche automated solutions like ALM, IFRS, Basel and more.

Operational Impact of iWARE & Gains

- Automation of the end-to-end workflow of regulatory reporting, from collection of the data to validation, and to report delivery results in huge reductions in time, effort, errors and expenses for the Banks/FI.

- Automation above frees up time & resources for meaningful data analysis, alongwith the backbone or framework of Data repository which promotes Data Analytics.

iWARE Solution: Features & Highlights

In the creation of Data Repository or Data Vault, the following features & capabilities of the solution stand out:

- a. Data Acquisition from varied sources like CBS, Legacy, Treasury, ALM and other systems thru ETL

- b. Data Cleaning covers validations, integrity checks, conversion/processing before the submission & storage of QUALITY DATA in Repository or Park

- c. Data Retrieval/Channel layer ensures the Regulatory & Industry guidelines get maintained thru XBRL, XML, xls and flat file or any mandated, popular mode.

In the Compliance & Analytics, the following features & capabilities of the solution stand out:

Report Generator enables management, validation and automation of the process of generating regulatory reports, while giving the option to view and modify them as required.

Data Repository or Data Vault stores and manages the required data. The rules for any regulators can be set up such that the required reports get automatically populated with correct data.

Statutory Reporting promotes the automation & handling of Canned/Pre Defined Reports Report Builder promotes the design, variation & creation of AD-HOC Reports.

Analytic Capabilities allow for drilling down from a [Label] or [Data] on a report to the underlying data, seeing the rules/calculations that got applied.

It allows performing variance analyses, comparing any period of reports and data, and setting variance thresholds/limits.

Manual adjustments can be achieved with tight control and allowing for all modifications to be logged & audited.

Why Virmati's iWARE

The following highlights the attributes that make Virmati & iWARE a perfect choice:

- a. Fully compliant & in-line with Reserve Bank of India recommnendations

- b. Ability to adopt RBI Taxonomy as & when released

- c. Excellent XBRL integration & reporting abilities.

- d. Authored by Banking Industry Specialists with deep insights into Operational Systems & Indian Banking Regulations over decades

- e. Technology Support or Software Assurance that ensures & insures against evolving & changing regulatory environment and also bringing performance improvements. The Support & Update Program takes care of New Reporting Changes, Logic Changes, New XBRL Delivery formats, Taxonomy Announcements, etc