Islamic Banking

The Islamic bank is a mix of commercial bank and investment bank. The banking operations are highly compatible with Islamic norms. Furthermore the system protects the depositors and gives them an adequate rate of return.

Islamic banks operate on the basis of profit and not on paying and receiving interest. The bank earns profit from three areas: trading, leasing and by direct financing in Profit-and-Loss-Sharing contracts. Different instruments are devised to earn profit in any of these ways. The structure and conditions of these transactions conforms to the Shari´a and fulfill its desired objectives.

Islamic Banking Solutions by Virmati

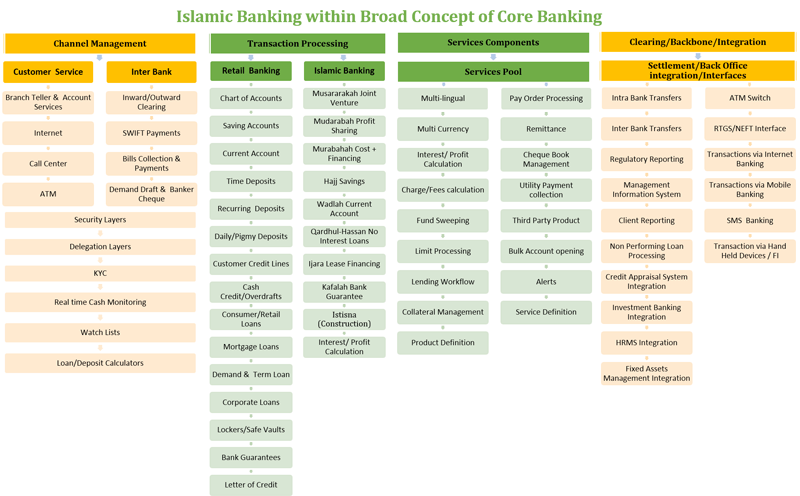

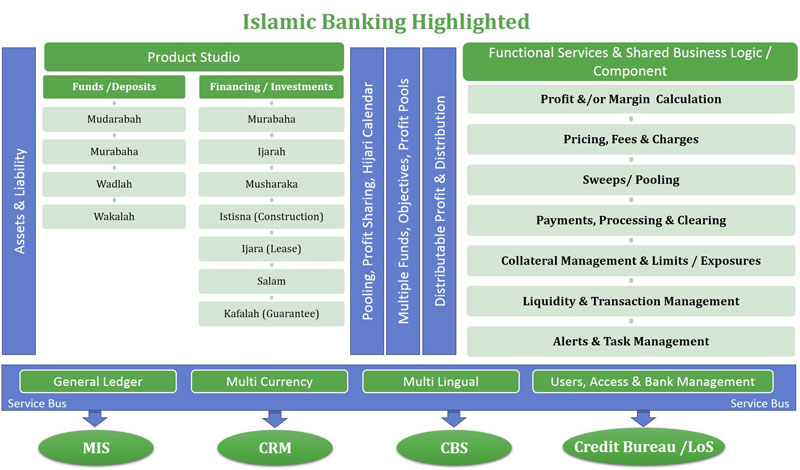

Part of Whole Suite of Universal Banking Solutions from Virmati, the “iCBS IB” viz. the Islamic Banking Solution offers a flexible, yet an integrated, comprehensive package to Institutions to enable them to offer Shariah-compliant products to customers across Consumer, SME & Corporate segments.

Virmati’s "iCBS IB" Islamic Banking solution offers necessary separation of Islamic Financial products, strong product definition features, Islamic accounting, audit trail, aggregation structure for accruing returns and much more!!

The depth of the Virmati’s "iCBS IB" Islamic Banking Solution gives it leverage for region-specific Islamic Banking requirements, which differ from country to country.

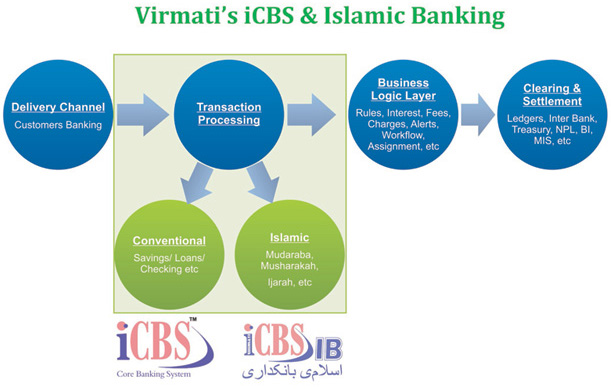

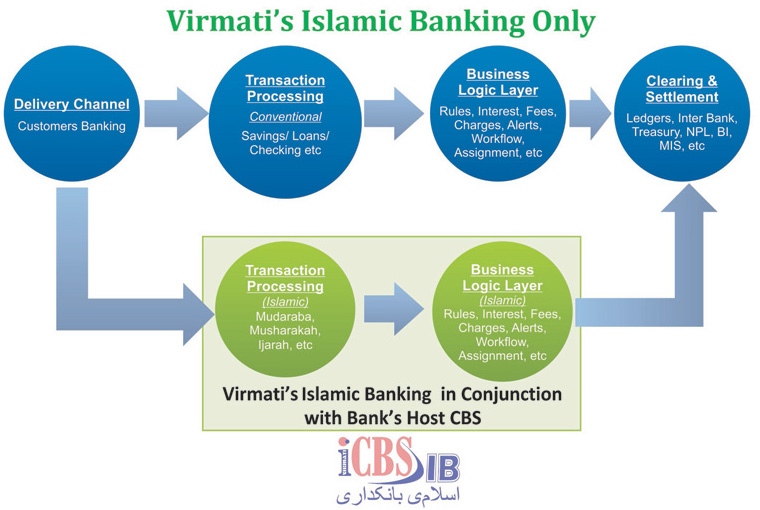

The Islamic Banking Solution can be installed as a complete, end-to-end package, or can be deployed in extensible modules completely integrated with existing Host Core Banking/Legacy systems, according to the footprint and needs of the financial institution.

Often, accompanied with iCBS – the Core Banking Solution for conventional banking, Virmati can also offer a combination addressing both Islamic banking and Conventional banking needs.

"iCBS IB" empowers Banks/MFIs o explore new business opportunities, capture new potential customers, maximize their investments and efficiency, in full compliance with Sharia rules and regulations.

Application Features:

- Profit sharing purely parameterized

- Advance calculations and post calculations available for various schemes

- Flat profit calculation with reducing Equated Monthly Installment setup and Profit sharing facility.

Popular Types of Accounts Supported by the System with Islamic Rules and Norms with Actual accounting as per the Islamic Law:

- Muduraba

- Musharaka

- Murabaha

- Ijara

- Ijarawaiqtin’a & so on..

- Bai Salam & Parallel Salam

- Tawarruq

- Istisna