Inter Bank Banking

When Automation began in banking, there were departmental PCs in each Branch. Later on, PCs got connected and the Branches had a Local Area Network (LAN). Then the Branches got connected and the Bank had a Core Banking Solution with Centralized Database and Application.

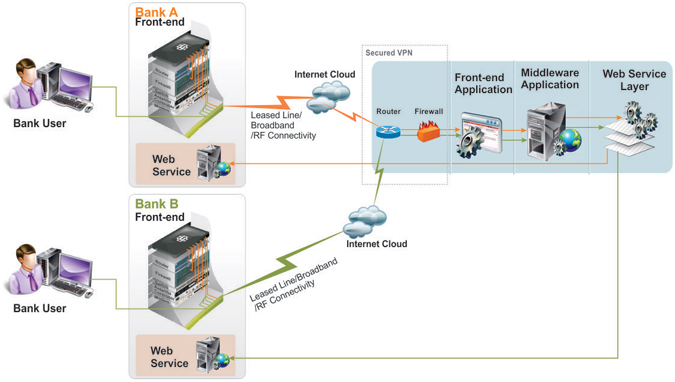

The world is moving on…The need of ours is: “Inter Bank Banking” (IBB).

There were some traditional ways of Inter Bank Banking: For example, Demand Draft, Banker’s Cheque, RTGS or Electronic Fund Transfer, etc.. But, that form now needs to be more real time and online mode-hence, IBB.

IBB would be between Banks in a hierarchy. For example, in India, every State has an Apex Bank, under which there are District Banks in each District of the State and under them, there are Urban Co-operative Banks (Community Banks). They can all work under one network through IBB.

Similarly, another example is a Public Sector Bank in India has a few Regional Rural Banks. They can also work through IBB.

In the global arena, this IBB would mean: major Banks of a Country may come together, to offer the luxury of Inter Bank Banking to their customers. And this can take the shape of such arrangement across the frontiers and across the continents as well.