Virtual Banking

BFSI world is moving towards the era of Virtual Banking.

In the present scenario all clients related to the Banking and other sectors has to do some sort of transaction in their everyday life. Their transaction come through various location and time which includes Railway Station, Airports, Hospitals, Super Market etc., This is possible through Virtual Banking wherein the customers have no time restriction or do they need any electronic device to any transaction. It is a form of self-made support system.

Innumerable number of clients / customers now prefers to carry on their banking related transactions in a simpler, cheaper way at all the time irrespective of the geographical locations. This is where this Virtual Banking comes as a boon to all the clients.

Virtual Banking (VB) is a strategy of distribution channels which are used to provide financial services and seeks to expand the concept of the traditional bank branch. This is done through the growth and development of technology.

This is the latest and foremost form of present day banking where most of the services are delivered “Virtually”. Means the services are delivered through Web and there is almost 1 to 2% eventuality that customers require their physical presence at their Bank Branch.

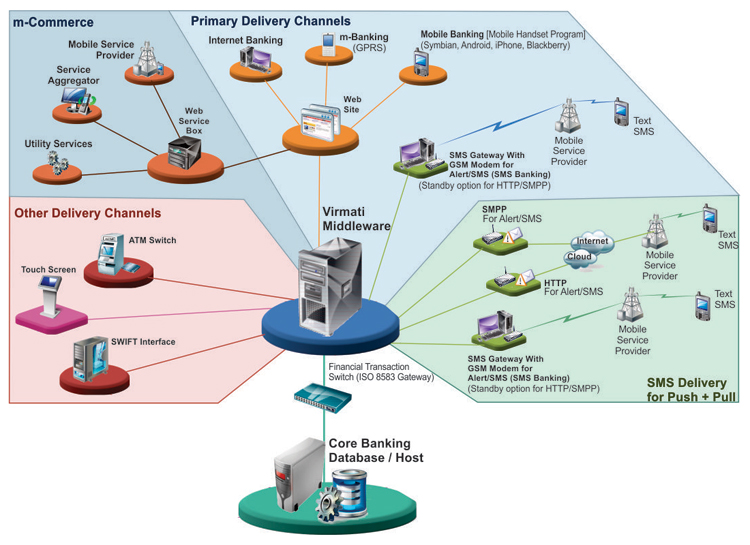

Virmati’s iCBS Middleware is based on the integration of such technologies as the internet, mobile phone, and others which allow the client identification, and recording transactions carried out by clients, but electronically.

It is a comprehensive solution for banks/institutaions to manage the full-fledged Branchless Delivery or Direct Banking, thru the internet or mobile or call-center.

It allows banks to expand in new markets, reduce operational issues, take banking services to the doorsteps of its existing & potential customers. In a nutshell, iCBS Middleware is a technology enabler or technology infrastructure to drive customer acquisition, servicing & thus extend branch-less bank’s outreach.

The different channels are utilised as an interface with a Host CBS - core banking solution through a custom built middle-ware. It provides customers of the bank, real-time access to their relationships in the bank such as account inquiries, fund transfers, credit cards, payments and remittances, where one can make payments to individuals or institutions and other general payments on-line.

ICBS Middleware e-Banking is based on n-tier architecture. It offers a high degree of scalability as it can be used in both small application server environments and in multi-server distributed processing environments. The solution is platform independent. It is highly secured and provides support for different authentication mechanisms.

b. Over Wifi

b. Browser

Third Party

The same middleware can also handle the following further Delivery Channels:

- Customer Kiosks/Touch Screen Kiosk

- ATM Switch Interface

Technology Details